Why Pet Insurance?

Pet insurance can help provide a safety net for your team’s furry family members—it’s a strategic employee benefit that can help reduce employee stress and boost loyalty.

Providing pet-friendly benefits like OnePack Plan pet insurance helps employees to better prioritize their pets’ well-being with less stress about unexpected vet bills and eligible medical expenses.

A Growing Priority for Employees

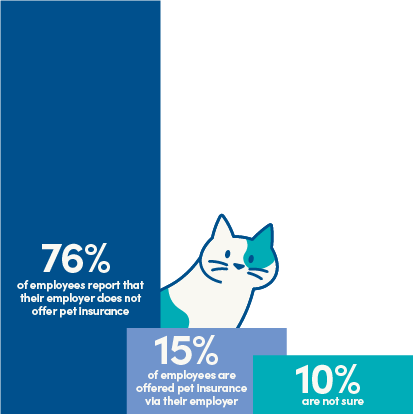

A staggering 76% of employees report that their employer does not currently offer pet insurance despite a significant unmet demand for pet-friendly benefits.* And it’s not just financials on these employees’ minds — they’re increasingly seeking various benefits that facilitate today's pet parenting lifestyle.

This includes personal time off for pet emergencies and travel plans. 67% of pet owners say they would take PTO for pet-related care, and over half already have.*

This study was featured in:

Pet Insurance: A Game-Changer for Recruitment and Retention

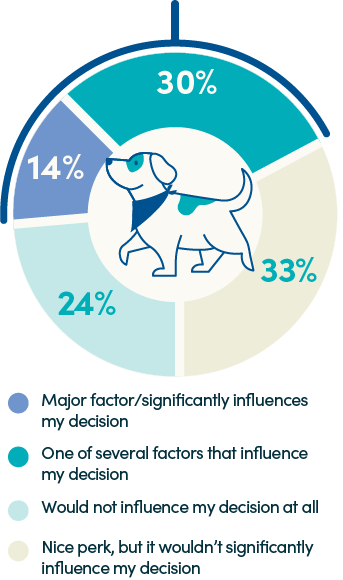

Our research found that 64% of pet owners say PTO for pet emergencies would influence their decision to join or stay with a company*. Even non-pet owners recognize the value— half of them said they would be more likely to consider getting a pet if their employer offered pet insurance. These insights demonstrate that pet insurance isn’t just a perk—it’s a competitive differentiator in today’s job market.

In fact, 44% of employees consider pet-related benefits important when evaluating new job opportunities, ranking these benefits on par with other key perks*. Offering this coverage fosters a sense of security and belonging, helping to attract top talent and reduce turnover.

44% of employees say that a pet-friendly office would influence their decision about taking a new job.

Pets Are Family—and Care Can Be Costly

94% of people consider their pets part of the family,** and with the rising cost of care, financial burdens can quickly become overwhelming. Our survey found that 55% of pet owners feel discouraged from traveling due to the risk of costly pet-related accidents, and 62% are influenced by boarding expenses when planning time off.*

When employers provide pet insurance, employees are empowered to better manage these expenses and ensure their pets receive the care they need.

Here’s How Pet Insurance Works

Pet parents should never have to make a difficult decision about their pet’s health for financial reasons. Pet insurance can help reimburse the cost of eligible veterinary and pet healthcare expenses. Here’s how it works:

Visit any licensed vet in the U.S. or Canada.

Pay the bill and submit a claim.

Get reimbursed directly for eligible expenses by direct deposit or check.

OnePack Plan’s simple claims and reimbursements help employees focus on what matters most: their pet’s well-being.

Leading the Pack with OnePack Plan

We’ve designed OnePack Plan to fit seamlessly into your benefits package, reducing administrative hurdles for HR teams while offering employees the peace of mind that comes with coverage. It’s no wonder two-thirds of pet owners say employer support for pet care is crucial to their well-being at work.*

A Flexible and Inclusive Benefit

Whether it’s reimbursing eligible preventive care costs or unexpected injuries, OnePack Plan can help your employees feel supported. Pet owners, on average, selected a pet benefit over a conventional benefit half of the time.

What does this tell us? Companies that offer pet insurance demonstrate they understand and care about the evolving needs of today’s workforce.

Make Pet Insurance Part of Your Benefits Package

Offering pet insurance isn’t just a benefit—it’s a strategic commitment to employee satisfaction and loyalty. Join the growing number of companies that prioritize their employees and their pets.